The coronavirus impact on business was monstrous, leaving no stone unturned—even the “essential” engineering jobs felt the pinch.

As a power engineer and business owner, let me give you the inside scoop on how COVID-19 sent shockwaves through my world. Keep in mind, I was considered an essential worker during the pandemic.

My experience when COVID-19 shut economies down

I vividly remember how the usually jam-packed highways of the Bay Area in California turned into ghost towns. Even at rush hour, it was eerily quiet.

My clients and subcontractors seemed to vanish into thin air, and high-priority water and power projects were put on ice. Our customers faced a whirlwind of challenges, including:

- Fear: Worrying about their own health and that of their loved ones

- General uncertainty: Not knowing if things would go from bad to worse

- Engineering project funding: Wavering over the availability of funds

- Social distancing: The impracticality of keeping a 6-feet distance on some project sites

To truly understand the economic impact of COVID-19, let’s take a trip down memory lane to the 2008 Great Recession.

2020 market versus the 2008 Great Recession

Back in 2008, a deregulated financial market almost bulldozed the entire U.S. economy. Banks spiraled out of control as they:

- Sold mortgage derivatives without shouldering default risks

- Chased after processing more and more loans

- Crafted interest-only loans for subprime borrowers with relaxed lending

- Approved a tidal wave of underqualified buyers

- Witnessed buyers falling behind on mortgages, leading to short sales and bankruptcies

- Froze credit due to soaring default rates in their loan portfolios

In the aftermath, the government swooped in to prevent another Great Depression. However, countless businesses still bit the dust as credit evaporated and banks teetered on the edge of collapse.

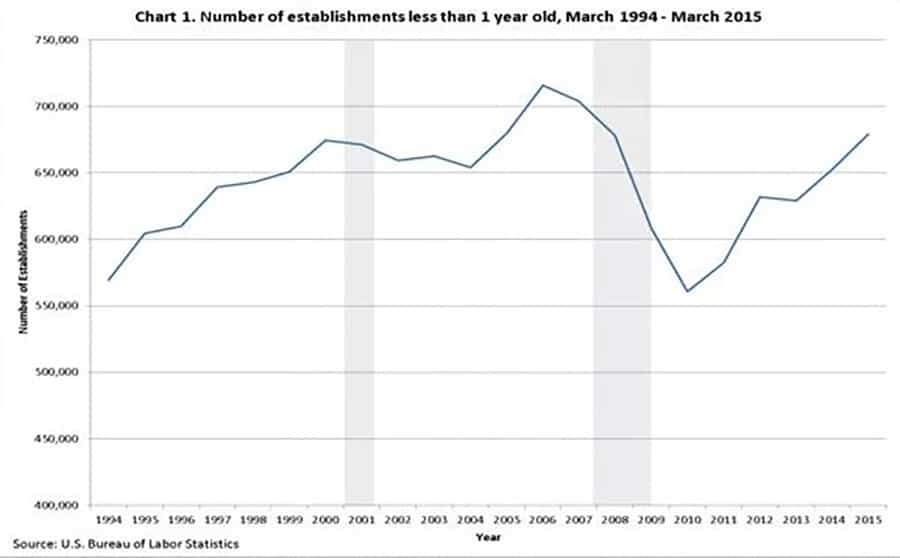

Now, let’s examine the chaos through the lens of the Bureau of Labor Statistics’ data. Before the 2008 crash, the U.S. created approximately 670,000 businesses yearly. By 2010, that number plummeted to 560,000.

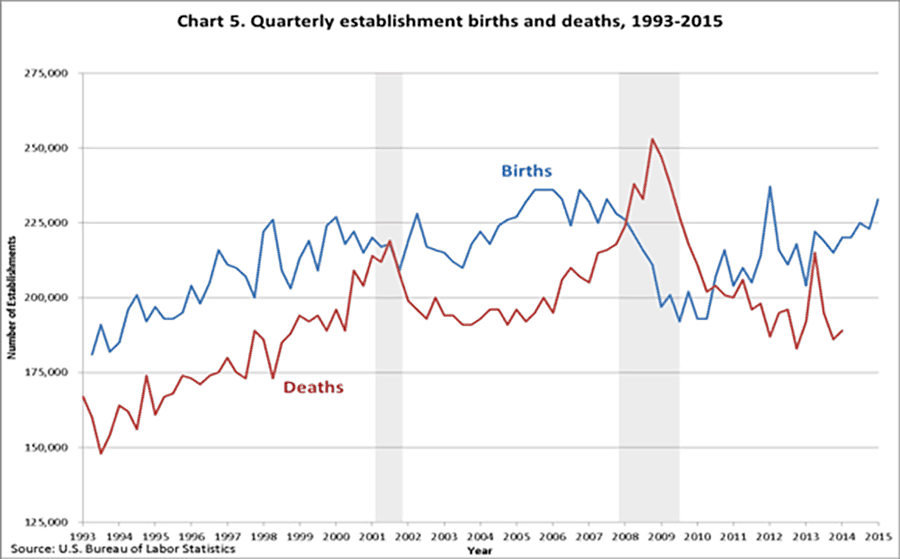

The below graph from the Bureau of Labor Statistics reveals a surge in business closures. Roughly 170,000 small businesses closed their doors between December 2008 and December 2010.

This market turmoil snuffed out millions of jobs—8.7 million, to be exact, from December 2007 to December 2009. Even the once-invincible Silicon Valley jobs were swallowed by the abyss. These were startups and companies thought to be immune to market dips.

Essential engineer jobs in the 2008 Great Recession

In non-software related engineering fields, the following unfolded:

- Tightened bank lending

- A glut of homes flooding the market due to skyrocketing mortgage defaults

- Halted housing construction as builders couldn’t secure loans

- Engineers unable to design for increased demand, resulting in layoffs

Structural, civil, and power engineers usually design for future demand. The idea is to use today’s dollars to build for tomorrow. But with the economic squeeze, employers couldn’t afford to keep idle engineers on the payroll.

2020 coronavirus impact on small businesses

Fast forward to 2020, and the coronavirus pandemic sucker-punched small businesses in a whole new way. It wasn’t greed this time; it was a nasty virus that revealed some major flaws in America’s supply chain. With the country heavily relying on China for essential supplies, we found ourselves high and dry. This disruption rippled through every industry, causing chaos and forcing countless small businesses to shut their doors.

You see, small businesses are the lifeblood of the American economy. According to the US Small Business Administration, they made up 64% of net new jobs created between 1993 and 2011. That’s a whopping 11.8 million of the 18.5 million net new jobs created! They account for 44% of the total private payroll and support many Fortune 100 companies like Google and Facebook with their ad spending.

Take Yelp, for example. Before the pandemic, it was valued at over $3.5 billion. But when COVID-19 hit, its share price plummeted from around $35 to $17.

And let’s not forget that small businesses are the breeding ground for tomorrow’s superstars. Think about the humble beginnings of legends like:

- Henry Ford (Ford)

- Bill Gates (Microsoft)

- Sam Walton (Walmart)

- Steve Jobs (Apple)

- Larry Page and Sergey Brin (Google)

- Elon Musk (Space X and Tesla)

These once-small businesses now employ millions of people!

Economic shutdowns: a death sentence for small businesses

According to the Census Bureau, a whopping 99.7% of US businesses have fewer than 500 workers. And let’s be real, most small businesses don’t have a Scrooge McDuck-style vault of cash lying around. Unlike Google and Apple, with their billions in the bank.

Instead, most small businesses are like sharks: they need to keep moving or they’ll die. They rely on a constant flow of work to stay afloat, trading hours for dollars instead of scaling through endless online widget sales.

That’s why a sustained, unplanned shutdown is like signing their death warrant!

Coronavirus impact on essential engineering jobs

Take me, for example. I don’t go out and fix fallen power poles. My job is design and research, working on things like:

- Upgrading water or wastewater treatment plants for increased capacity

- Improving filtration equipment for better water treatment

- Retrofitting and upsizing substations to meet power demands

- Replacing old, failed electrical equipment

- Enhancing power system protection and reliability through relay upgrades

These projects depend on thriving economies. So, unless equipment fails, engineers like me wouldn’t have much to design.

During the pandemic, cities and counties stopped funding projects and redirected funds to tackle COVID-19. Private businesses also put their engineering operations on ice, hoarding cash due to the uncertainty.

Think about your own financial situation. If you lose your job, are you going to buy a bigger house and a fancier car? No way, unless you’re rolling in dough or just plain crazy.

So yeah, even essential engineers like me aren’t immune to pandemics.

Coronavirus impact on business will drive the world in a new direction

Our economies aren’t designed to sit idle with credit lines frozen. The consequences can be disastrous, affecting everyone, including engineers.

But hey, I’m an optimist! I truly believe that the pandemic is nudging us towards some much-needed positive changes. By embracing the following steps, we just might dodge future economic bullets:

- Bringing manufacturing jobs, especially for essential supplies, back to the good ol’ USA

- Stepping up our game with medical screenings for travel and immigration

- Fine-tuning our virus outbreak response game plan

- Pumping up the investment in medical research for vaccines and treatments

One thing’s for sure: our economy is way more delicate than we ever imagined. We’ve got to get our act together and be ready for anything – even, say, a massive coronal mass ejection from the sun.

Has the coronavirus permanently altered the way businesses operate? How should global governments tackle future virus outbreaks?

Author Bio: Koosha started Engineer Calcs in 2019 to help people better understand the engineering and construction industry, and to discuss various science and engineering-related topics to make people think. He has been working in the engineering and tech industry in California for well over 15 years now and is a licensed professional electrical engineer, and also has various entrepreneurial pursuits.

Koosha has an extensive background in the design and specification of electrical systems with areas of expertise including power generation, transmission, distribution, instrumentation and controls, and water distribution and pumping as well as alternative energy (wind, solar, geothermal, and storage).

Koosha is most interested in engineering innovations, the cosmos, sports, fitness, and our history and future.